VICTORIA, BRITISH COLUMBIA — 25 JUNE 2024 — Southstone Minerals Limited (“Southstone” or the “Company”) (TSX.V – SML) is pleased to provide an update on diamond sales from the Company’s majority owned Oena Diamond Mine (“Oena”), Republic of South Africa for the period 1 March 2024 to 31 May 2024 (“Q3 2024”) and June 2024 diamond sales (part of Q4 2024).

During Q3 2024, three diamond tenders were held at CS Diamonds (Pty) Ltd and one tender was held in June 2024. These four tenders represent mine diamond production from 1 February 2024 to a cutoff date of 17 May 2024. Tender 13 was in inventory at the end of Q3 2024.

In Q3 2024, a total of 432.01 carats (170 diamonds) were sold by African Star Minerals (Pty) Limited (“African Star”), the Company’s South African subsidiary, with an average price per carat of USD $1,353 per carat (Table 1). In month one of Q4 2024 a total of 164.11 carats (53 diamonds) were sold by African Star with an average price per carat of USD $2,736 per carat (Table 1).

Total sales from Q1 2024 to date is 796.5 carats with gross revenue of USD $1,495,700 and an average of USD $1,878 per carat.

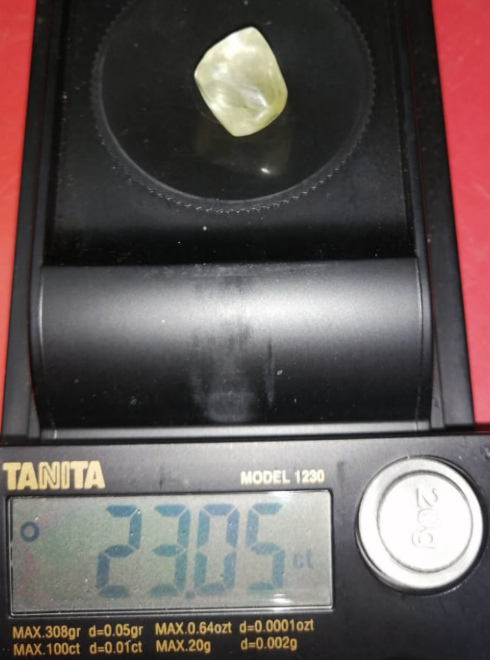

Seven notable specials (>10.8 carats) were produced are listed in (Table 2 and Photo 1 below).

| Mining location | African Star Tender No.

CS Diamonds Tender No. Sale Date |

Carats sold | Gross revenue (USD) | Price per carat (USD) | |

| Q3 2024 | Sandberg

Section |

Tender 10

CS Diamonds Tender CS253 21 March 2024 |

101.51

(45 diamonds) |

$147,293 | $1,451 |

| Q3 2024 | Sandberg

Section & Oena Section |

Tender 11

CS Diamonds Tender CS254 18 April 2024 |

150.60

(77 diamonds) |

$227,339 | $1,589 |

| Q3 2024 | Sandberg

Section

|

Tender 12

CS Diamonds Tender CS255 23 May 2024 |

179.90

(48 diamonds) |

$209,870 | $1,167 |

| TOTAL

Q3 2024 |

432.01

(170 diamonds) |

$584,501 | $1,353 | ||

| Q4 2024

(note PARTIAL) |

Sandberg

Section

|

Tender 13

CS Diamonds Tender CS256 20 June 2024 |

164.11

(53 diamonds) |

$448,957 | $2,736 |

Table 1: Q3 2024 Diamond Production and including Tender 13 in Q4 2024

| Diamond | Mining location | African Star Tender No.

CS Diamonds Tender No. |

Weight sold (carats) | Gross revenue (USD) | Price per carat

(USD) |

|

| 1 | Sandberg Section | Tender 10 (CS253) | 18.76 | $67’076 | $3’575 | |

| 2 | Sandberg Section | Tender 11 (CS254) | 16.91 | $60’500 | $3’578 | |

| 3 | Sandberg Section | Tender 12 (CS255) | 34.56 | $75’000 | $2’170 | |

| 4 | Sandberg Section | Tender 13 (CS256) | 23.06 | $225’559 | $9’781 | |

| 5 | Sandberg Section | Tender 13 (CS256) | 13.04 | $27’600 | $2’116 | |

| 6 | Sandberg Section | Tender 13 (CS256) | 13.24 | $74’369 | $5’617 | |

| 7 | Sandberg Section | Tender 13 (CS256) | 15.19 | $46’888 | $3’088 | |

Table 2: Notable Diamonds Sold Q3 2024 Diamond Specials (>10.8 carats) Production (including June 2024 – Tender 13 in Q4 2024)

Southstone manages Oena and is responsible for diamond sales, operational and mining consultation with the contractor, mining license reporting requirements and security. The Company maintains a management and security team in South Africa, including the CEO of African Star and the Oena Operational Site Manager. The Company’s Executive Chairman, with external geological support, provides operational support for internal reporting of Oena activities and provides geological and technical support to the operations team and contractors.

During Q3 2024, mining was focused on Sandberg Section with a double sixteen-foot pan and an onsite Bourevestnik X-Ray Unit (“BVX”) and flow sort to process material from Sandberg with some minor production from Oena Section. Between 7 November 2023 and 17 May 2024 an estimated total of 231,000 tonnes of run of mine material has been processed, producing 796.5 carats with an average of 2.46 carats per diamond and an average of USD$1,878 per carat. On 18 May 2024, the contractors put Oena on care and maintenance and mining operations will recommence on 1 July 2024.

The technical disclosure in this news release has been approved by Terry L. Tucker, P.Geo., Executive Chairman of the Company, and a Qualified Person as defined by National Instrument 43-101 of the Canadian Securities Administrators.

ON BEHALF OF SOUTHSTONE MINERALS LIMITED

Terry L. Tucker, P.Geo.

Executive Chairman

For additional information, please contact Terry L. Tucker at info@southstoneminerals.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Capitalized terms used herein that have not been defined have the same meanings ascribed in the policies of the TSX.V.

Forward Looking Statements Disclaimer

Certain statements in this release are forward-looking statements, which are statements that are not purely historical, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward looking statements in this news release include statements relating to the Company’s proposed production timeline, and the Company’s plans for future production from the Oena Diamond Mine. Forward-looking statements are often identified by terms such as “will”, “may”, “should”, “anticipate”, “expects” and similar expressions. All statements included in this news release, other than statements of historical fact, are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include quality and quantity of any mineral deposits that may be located, the Company’s inability to obtain any necessary permits, consents or authorizations required for its activities, the Company’s inability to raise the necessary capital to be fully able to implement its business strategies, and other risks and uncertainties disclosed in the Company’s latest interim Management Discussion and Analysis filed with certain securities commissions in Canada.

The reader is cautioned that assumptions used in the preparation of any forward-looking statements herein may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect, and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements as expressly required by Canadian securities law.

Map 1 – Location of Mining Sections and Mining License Boundary, Oena Diamond Mine.

Photo 1 – 23.06 Carat “Special” – price of USD $9,781 per carat.